Why should B2B Businesses Embrace Online Platforms?

How the rise in online B2C spend may effect B2B markets.

Statistics from the B2C market show strong indications that consumers may retain a high percentage of their spend online for at least the next 12 months, there are predictions that the same trends will emerge in the B2B market. We interview our MD’s James Simpkins and Paul Godwin for their thoughts on buying behaviours and the need for B2B online platform investment …

A result of the pandemic?

Q1) There is no doubt that the global coronavirus pandemic has changed buying behaviors in both the B2B and B2C markets, but do you think it is the sole cause of the seismic shift in attitudes we are seeing?

PG) We have been in the B2B space for forty years and have seen trends in buying that have evolved over many years, and other trends that have evolved almost over night with the launch of a technological evolution or in response to an economic reality.

Let’s be honest, the move to greater online consumer spending is nothing new. Everyone recognises the Amazon ‘smile’ on a cardboard box and the tale of Alibaba’s rise to fame in China is told at most dining tables. Many B2C businesses have been revising their consumer models with fashion houses such as Karen Millen moving to online only to survive. B2B had not had the same pressures and whilst online behaviors were changing, the market was behind B2C when the Covid-19 outbreak hit.

Then the pandemic accelerated the change … exponentially. Within a month, a large percentage of consumers and businesses had to reach their target market through digital means and what became clear was those who had ‘planned’ for this future were able to react better than those who hadn’t. Time and budget pressures caught up with some brands whilst others who had a stronger online platform took market share; B&Q versus Screwfix was an interesting example.

What are the consumer trends?

Q2) What key trends to consumer behaviour has the pandemic exacerbated?

JS) Depending on which statistics you read results vary but generally eCommerce is up by between 20% and 25% on last year and surveys are showing in North America and Europe that there is now MORE people favoring online than shop in stores and that the majority of people will keep up a mixture of both in a post-covid world.

That’s fine for the food shop but what about bespoke products, luxury goods and tailored services? A key trend in behaviors we are seeing is the decline in face to face contact and relationship development between sales staff and the consumer; only 16% of sales so far this year was direct purchase. As physical contact remains on lockdown, we are going to see that trend extend across many B2C and B2B industries and its something I don’t think we can ignore.

Q3) That’s a concerning trend. Anything else about market behaviors we should be aware of?

PG) Well, the reduction in face to face selling has a knock-on effect down the supply change. Moving online and distance buying has put a huge amount of pressure on business supplier’s online presence and there are those who stood up to scrutiny and those who didn’t. Over 50% of B2B buyers have reportedly switched suppliers during the pandemic for reasons such as stock unavailable online, failures in online ordering and websites that crash. Businesses like consumers have a very short attention span and online UX is growing in importance.

JS) Exactly and we are seeing how the B2B customer experience is changing because of this. As buyers move their spend online, the reciprocal online experience needs to maximize conversion; i.e. be on brand, be easy and intuitive to use and ‘show’ why the consumer should choose that company. It’s the same for online events which is the key way B2B business will hone their online profile. We can really learn from the B2C market where having a website to sell online is simply not enough, B2C businesses use online platforms as the springboard by which they communicate their brand, trade their services and capture market share.

So what’s next for B2C?

Q4) How can B2B business catch up with B2C?

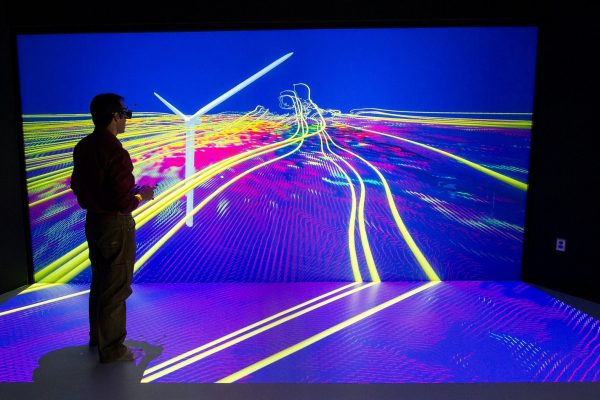

PG) Learn from the B2C market and polish the online experience. B2C portals such as Amazon and Disney+ are market leaders and there is no reason why B2B platforms can not do the same and create an ongoing immersive experience.

JS) Back up the platform as well by adapting to new technology, cloud based, SAAS, hosted infrastructures and microservices into the architecture. There are reasons why three in ten people buy on Amazon and its not the provenance of the goods, it’s the user experience of its platform and subsequent delivery logistics.

PG) And remember … Amazon Business is growing and has designs on the B2B market which is twice its size in monetary terms.

Q5) With live events still waiting for the all-clear, how are we working with B2B clients to bolster their online presence

PG) I think we can safely say effects of the pandemic are going to be more permanent than expected as businesses recognise the benefits of online consumers and we all move towards a more sustainable future. What we are working with clients on is a marriage of two elements; the need to reach a growing market of online consumers via a platform that offers immersive experiences and …

JS) … making sure that those reduced opportunities for face to face selling are capitalized upon to their maximum, albeit at a live event in 2021 or via digital channels. There is a need for a hybrid solution in the B2B market where businesses invest in the function of their online platform in preparation for this new future but also keep the main goal in mind – customer experience. By applying the same principles from live events, our clients are starting to really improve the online journey.

Clients are turning the virtual event experiences we design for them into an always on business environment; a window into their world for prospects and an online space in which their teams could operate and collaborate in 24/7. If other companies adopt the same principles, I predict it will be an exciting period of evolution for B2B marketing.